How this debt relief company scaled their paid social ads by 1,000%

- Paid Social

- Performance Creative

Originally, National Debt Relief approached WebMechanix in 2021 with the goal of increasing enrollments into their debt relief program. While their brand is widely known and reputable, consumers are often skeptical of debt relief programs.

Like most debt relief programs, National Debt Relief has specific requirements for enrollment when targeting specific consumers. But Facebook has placed limits on targeting and segmentation to avoid discrimination, meaning you cannot target based on age, gender, or race. We were challenged to not only drive enrollments and to prove to consumers that National Debt Relief had no other intentions than to just help them, but to also do all this within Facebook’s and Instagram’s extensive restrictions.

Once we cracked the code on Facebook, we had a new challenge: driving enrollments through multiple platforms (YouTube, Quora, etc.) instead of just Facebook and Instagram. This meant we would need to produce creative content at a much larger scale than before. Again, because each platform had their own limitations regarding debt relief advertisements, we had to work within these restrictions while still making engaging content that converts.

National Debt Relief and WebMechanix actively collaborated throughout the initial process of driving enrollments through Facebook and Instagram advertisements. After studying each platform’s restrictions, understanding National Debt Relief’s benefits for consumers, and leveraging their historical data, we were able to target groups of people who are more likely to acquire large amounts of debt.

Then, we pared these groups down based on the company’s eligibility criteria while also still

addressing the “red tape”. This led to producing creative that focused on consumers who have:

• Unsecured debt

• Excessive interest on their debt payments

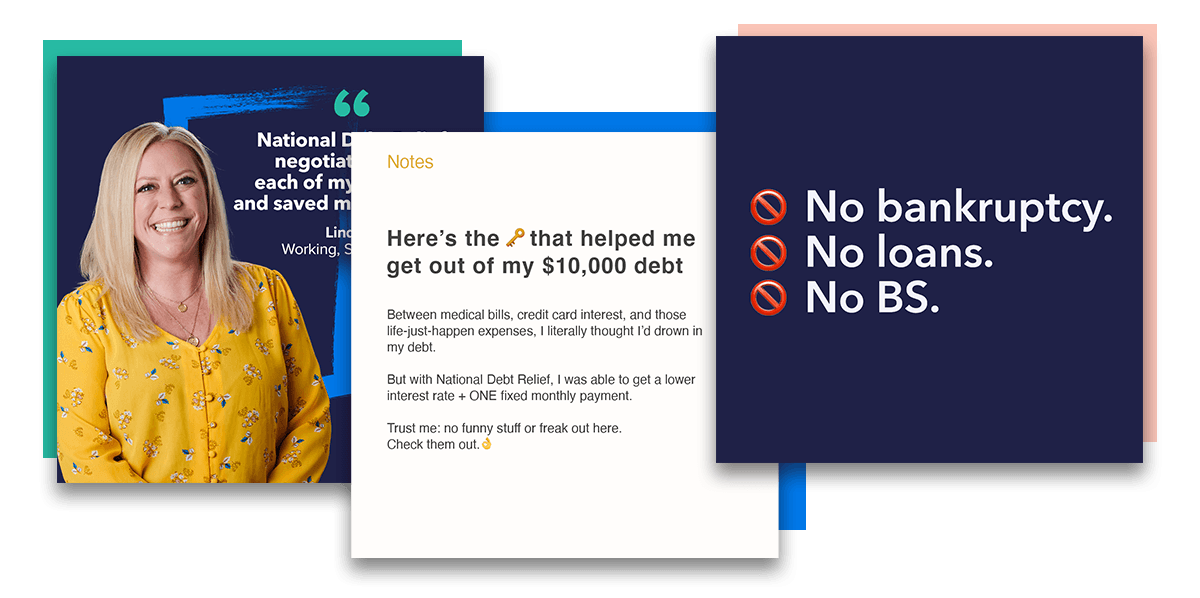

From there, we were able to heavily focus on creating a wide variety of social advertisements

(testimonials, text-heavy, etc.). These ads addressed the points above and simply explained how

National Debt Relief can help, but they also spoke directly to our target audience using

non-discriminatory criteria and extremely supportive language.

EX #1: Do what you love while we work on your debt

EX #2: Got debt? We’ve got relief. Here’s how to get out of $10,000+ debt for less than

what you owe.

Our strategies, over a one year period, resulted in:

• 705% increase in leads

• 1000% increase in spend (but still within budget)

National Debt Relief couldn’t believe that we were able to generate these kinds of numbers in such a short amount of time. Because their enrollments and operations grew rapidly, we were allowed to start focusing on driving results on multiple platforms.

In the last year, we pivoted quickly and efficiently to start producing content for YouTube, Quora, Snapchat, and more. While still addressing the target consumers above, we found that we could drive bigger results and have an even larger audience reach through things like:

• User-generated content such as how-to videos, number breakdowns, etc.

• Content that asks and answers common questions consumers would have about debt relief, providing full transparency into National Debt Relief’s services

• Surfacing interesting tidbits that consumers may have not known was possible for their debt

Even though this is still an ongoing effort, this has already resulted in 15x increased spend.

We’re continuing to strategize with National Debt Relief to ensure they get the most profitable results possible while continuing to scale ad spend. With the results we’ve gotten so far, we can’t wait to see the numbers this time next year.