How to use Facebook Ads to get mortgage leads that actually close

Running a successful mortgage campaign on Facebook can be challenging for many reasons. But from our experience, it’s worth the effort — Facebook Ads can be a highly-profitable and scalable source of mortgage leads & new loan volume, IF you set it up right.

In this article, we’ll break down the biggest mistakes we see advertisers making in the mortgage space, the biggest obstacles to running successful campaigns & how you can overcome them.

The biggest mistake mortgage advertisers make with Facebook

Most mortgage advertisers are trained to seek out as many leads as possible at the lowest cost per lead. But this is a big mistake, because not all leads are created equal.

Just because you got a lead, doesn’t mean it’s qualified or likely to close. In fact, there’s often an inverse relationship between the cost of the lead & its quality. In other words, the cheaper the lead, the less likely it is to close. So optimizing for “cost-per-lead” is really a race to the bottom.

The good news is there’s a better way: Train Facebook to find you better leads that are MORE likely to close. Your cost-per-lead will likely go up. But your cost per funded loan will drop through the floor… and the loan value can even go up as well.

We’re going to talk about how you can make that happen. But first, there’s one big obstacle that all mortgage lenders need to overcome when running Facebook Ads…

The #1 challenge when running Facebook Ads for mortgage

The single biggest hurdle for mortgage advertisers is overcoming targeting restrictions that Facebook has in place for HEC (Housing, Employment, and Credit) advertisers. HEC restrictions were implemented in 2019, and advertisers lost the ability to target by age, gender, zip code, and specific interest.

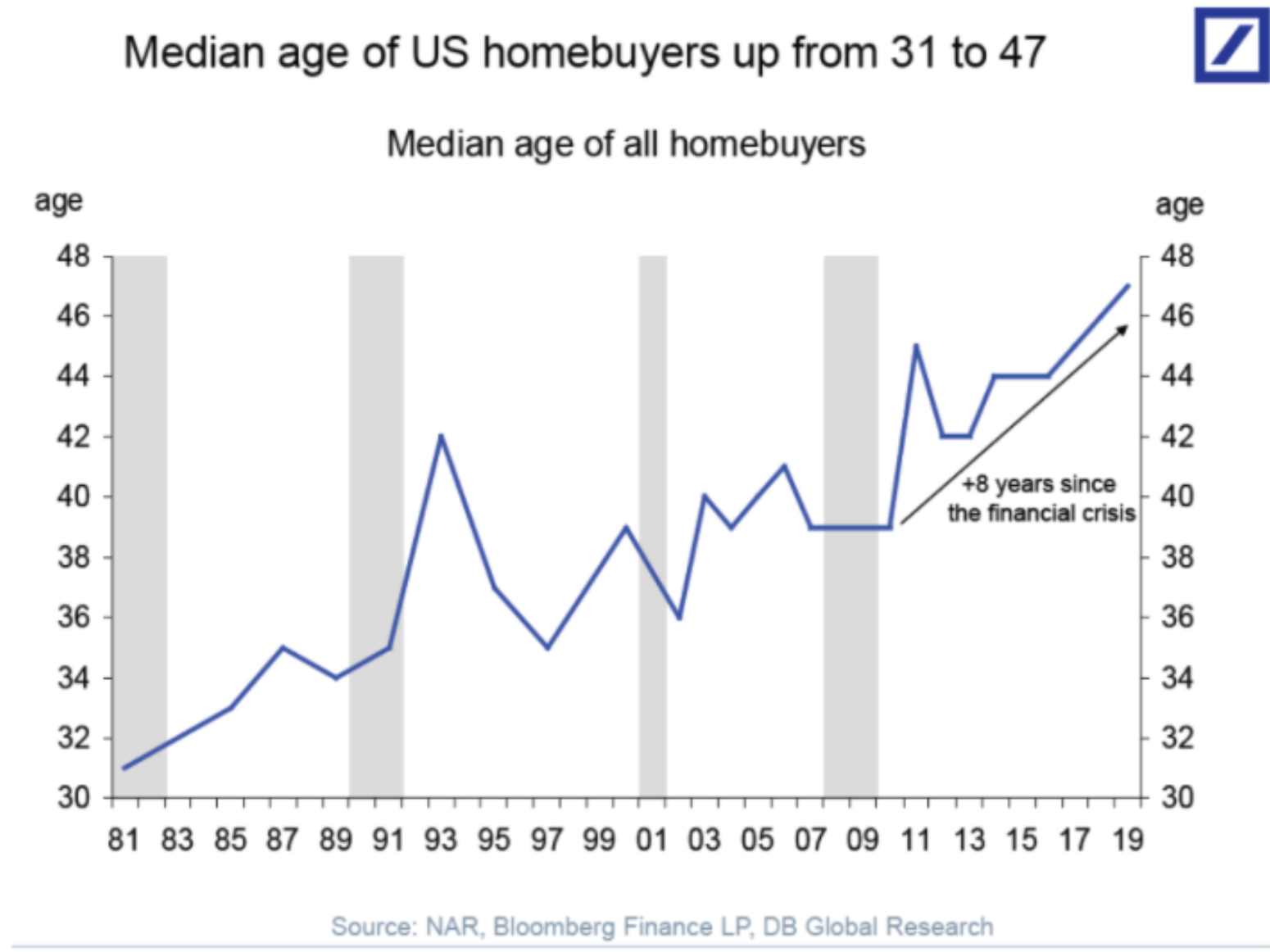

As the median age of US homebuyers increases, not being able to target by age can kill your campaign before it even starts.

However, there are three main things that we can control that most advertisers overlook, and we’ll dig into each one of these in detail:

- Pixel placement – How you are firing your conversion event, and at what point in the funnel are you firing it.

- RDO (Revenue-Driven Optimization) – Are you sending CRM data back into the ad platform? You want to be selective about what data you’re sending back to the platform. (Hint… if a lead is transferred to a loan officer, has good credit, and assets, this would be a great data point to send back to the platform.)

- Campaign structure – Siloing campaigns by creative theme can push the Facebook algorithm to target users interested in a specific value proposition.

(Disclaimer: This is not about “getting around” HEC compliance rules. Let’s be crystal clear about that. Rather, this approach allows you to ethically program Facebook to identify the right-fit customers for your lending criteria, while remaining in compliance with HEC rules.)

Pixel placement for mortgage Facebook Ads

Segmenting pixel events for specific filters can serve you well. Are you a mortgage advertiser that wants to service more refi consumers vs. new buyers? Well, this is where you would start.

If set up correctly, you will only fire your conversion event if a user selects “refinance.” Facebook will take notice, and its algorithm will naturally begin to push users who express an interest in a refi.

How does Facebook know this? Facebook alone has 52,000 data points, including:

- Every message you’ve ever sent or received

- Likely interests based off things you’ve liked and commented on

- Stickers you’ve sent

- Every time you log in, where you logged in from, what time, and from what device

- Every app you’ve ever had connected to your account

- Access to your webcam and microphone at any time

- Phone contacts, emails, calendar, call history, messages, downloaded files, games, photos and videos, music, search history, browsing history, etc.

There are other filters that we can fire events for as well, such as:

- LTV

- Mortgage balance

- Credit score

By setting more filters, you can refine your conversion criteria even further. But keep in mind that the more filters you stack, the higher your lead cost will be. We recommend choosing 1-2 of the most important criteria as filters to start.

Revenue-Driven Optimization for mortgage campaigns on Facebook

Facebook can optimize for events that happen offline by integrating your CRM with the Facebook Conversions API. In order for Facebook to record an event, it has to happen within 7 days of the last click, so sending data for users who fund will most likely result in no data being attributed to your campaign.

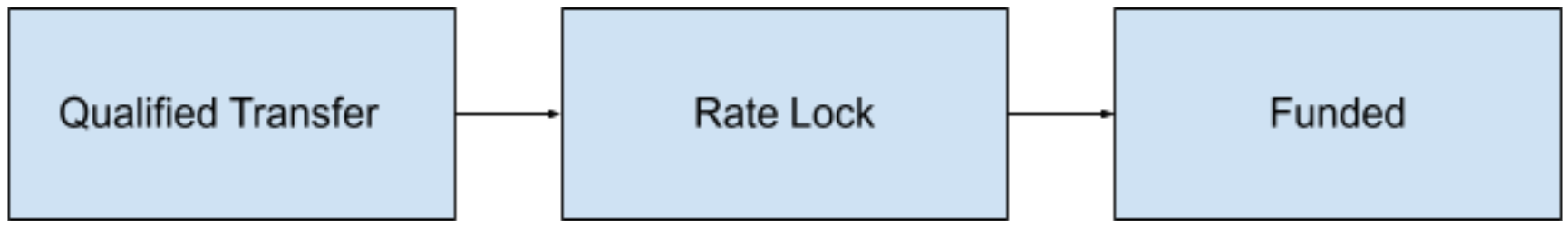

Standard mortgage funnel

Because of this limitation, the Qualified Transfer point is the ideal place in the customer journey for your CRM to post back data into Facebook.

Once Facebook receives enough Qualified Transfer events, you can change your conversion objective from a pixel-based event to CAPI event. Once you change your conversion objective, you should expect to see an increase in your cost per lead. However, your transfer rate, lock rate and funded rate will significantly increase as well.

Facebook campaign structure for mortgage lenders

Creative plays an important role here, but how you structure the creative is equally important. Campaigns should be segmented by the theme of the creative.

Potential themes might include:

- Lock in a low rate

- Buy your first home

- Get rid of PMI

- Take cash out

A user looking to take cash out of their home has a different motivation than someone who is looking for a lower rate and payment, so it’s important to keep these themes segmented. By doing this, you are creating a user experience that is hyper-targeted, which will lead to better metrics down-funnel.

Conclusion

Now you know the secrets to an effective mortgage campaign for Facebook Ads that will help you blow past 99% of other advertisers in the space.

If you have any questions or want to get help implementing this for your mortgage business, contact us here or schedule a time with our team to chat.

Most newsletters suck...

So while we technically have to call this a daily newsletter so people know what it is, it's anything but.

You won't find any 'industry standards' or 'guru best practices' here - only the real stuff that actually moves the needle.